Estimating volatility in the Merton model: The KMV estimate is not maximum likelihood - Christoffersen - 2022 - Mathematical Finance - Wiley Online Library

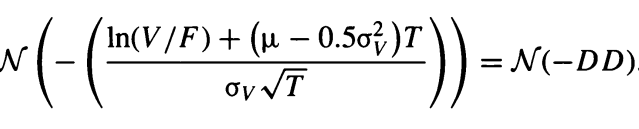

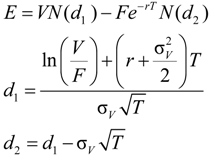

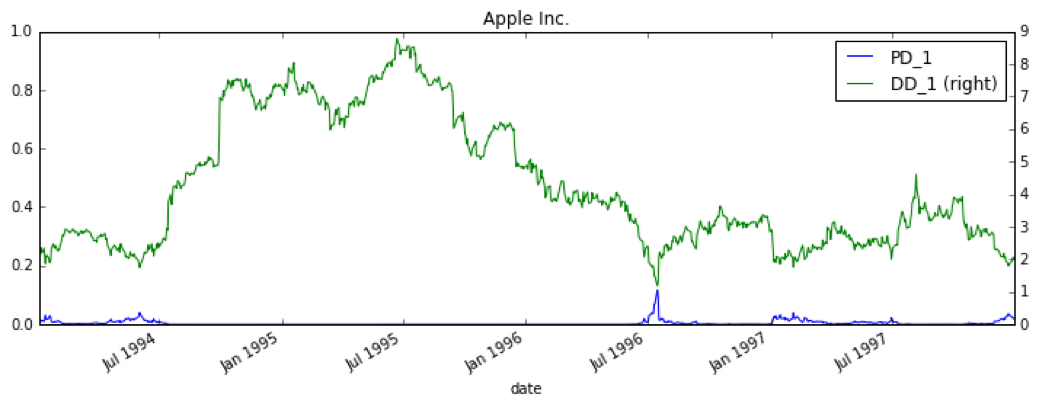

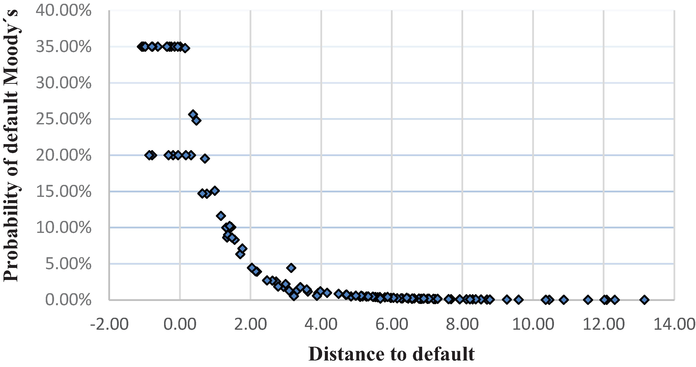

Modeling Default Probability via Structural Models of Credit Risk in Context of Emerging Markets | IntechOpen

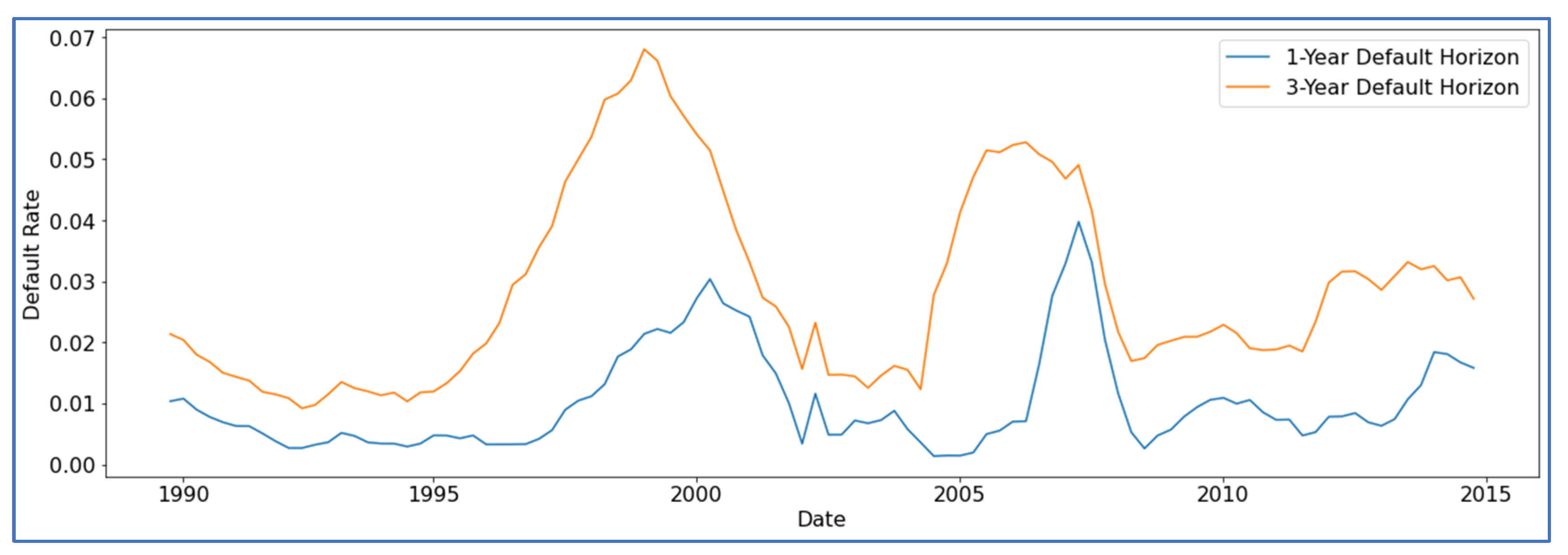

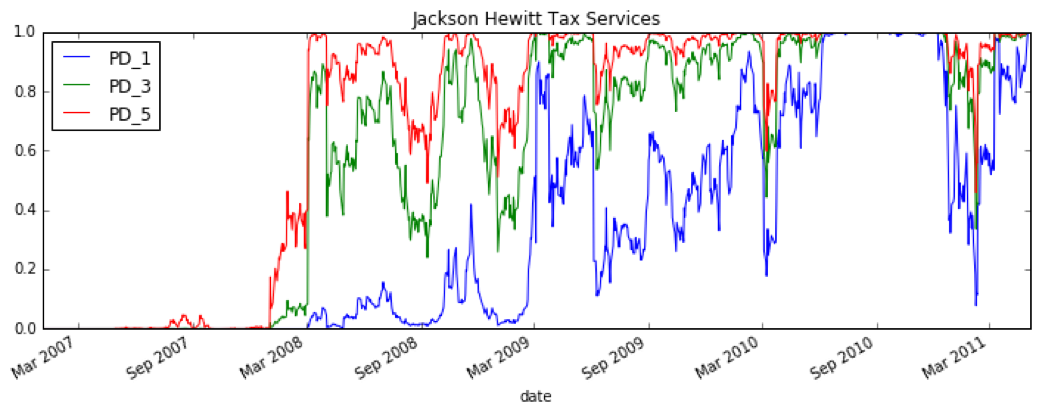

Bharath (2008 ) Merton DD paper - Forecasting Default with the Merton Distance to Default Model - Studocu

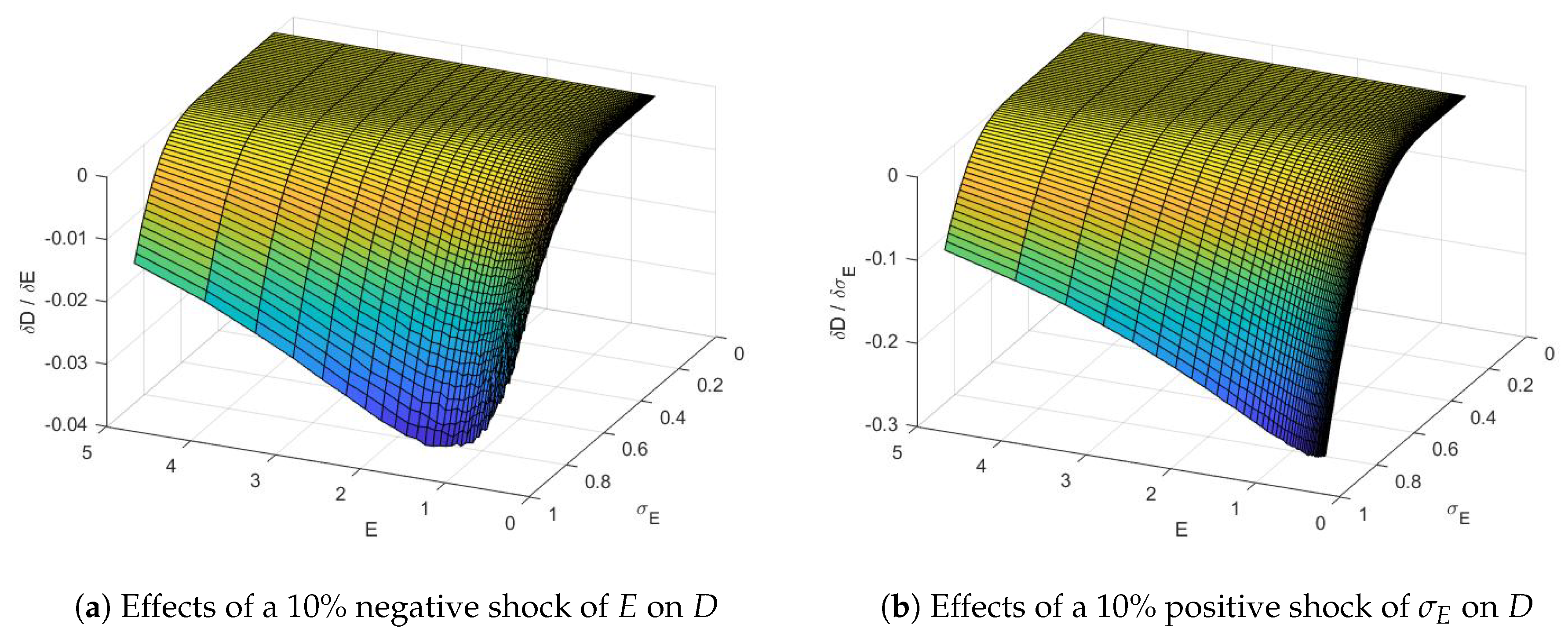

Estimating volatility in the Merton model: The KMV estimate is not maximum likelihood - Christoffersen - 2022 - Mathematical Finance - Wiley Online Library